2024 Allowable Business Expenses Dxc – However, it may be allowable when reasonable circumstances (e.g. timing issues) occur and a business reason for the use of this option is clearly documented. Only expenses directly related to the . Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations. Whether you’re an entrepreneur or a small business .

2024 Allowable Business Expenses Dxc

Source : covercannabis.comSenate passes $95 billion package with aid for Ukraine and Israel

Source : www.cnn.comMayor Bowser Presents Fiscal Year 2024 Budget Proposal | mayormb

Source : mayor.dc.govWall Street learns an important lesson. Don’t fight the Fed | CNN

Source : www.cnn.comD.C. United Signs Five Year Jersey Sponsorship With Guidehouse

Source : www.sportico.comTrump’s calendar becoming crowded as legal battles escalate in New

Source : coloradonewsline.comIP Consulting Group | Gaithersburg MD

Source : www.facebook.com2024 GIST Business Incubation | GIST Network

Source : www.gistnetwork.orgFact Check: ‘Where Did Our Money Go’ election flier | BenitoLink

Source : benitolink.com2024 State Business Tax Climate Index | Tax Foundation

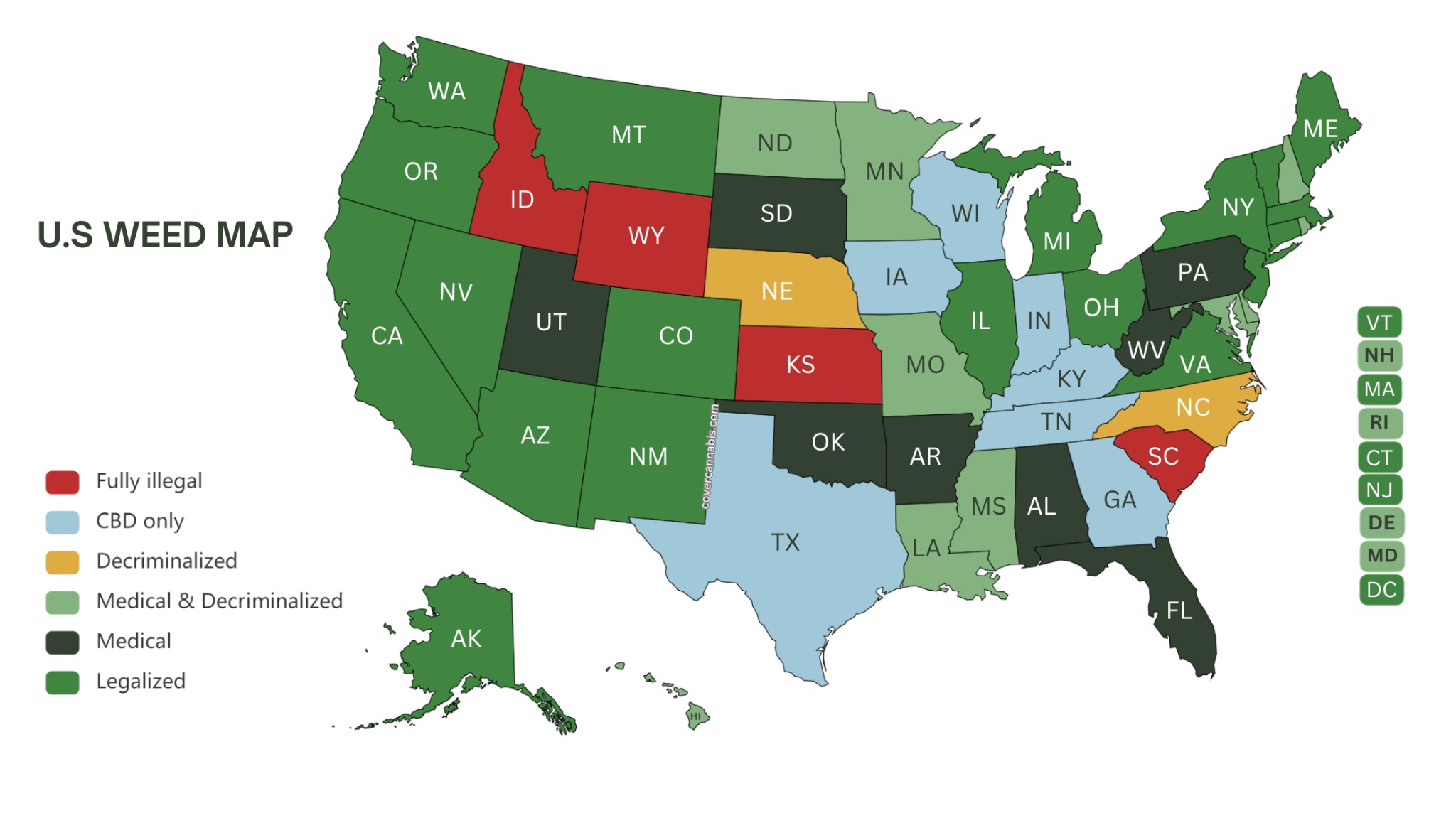

Source : taxfoundation.org2024 Allowable Business Expenses Dxc Where’s Weed Legal in the U.S? Jan 2024 Cover Cannabis: Business meals that exceed the meal allowance rate require an approved justification statement for up to 150% of the meal allowance and are allowable expenses to charge to State Funds. Meals that . You’re able to claim allowable business expenses for training that gives you the knowledge and skills to better run your business. This includes refresher courses. The course must be able to help you .

]]>